Ebanking is an online banking system that allows customers to perform financial transactions through a website or mobile app. It offers convenience, flexibility, and access to a wide range of banking services anytime, anywhere.

With ebanking, customers can check account balances, transfer funds, pay bills, apply for loans, and manage their financial information securely and efficiently. This digital banking solution has revolutionized the way people manage their finances, making it easier and more convenient than ever before.

Whether you’re at home, at work, or on the go, ebanking provides a seamless and efficient banking experience that saves time and offers greater control over your financial life.

Credit: www.bcbonline.com

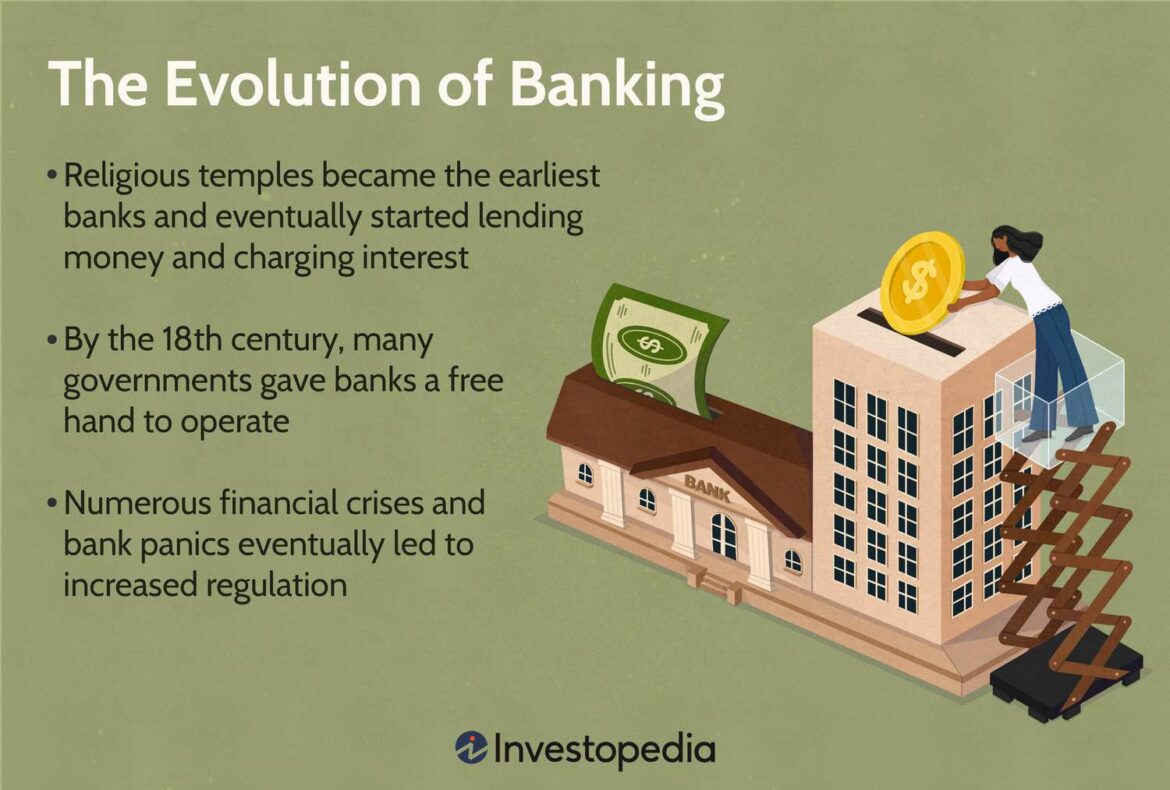

A Look Into The Past

The origins of electronic banking can be traced back to the mid-20th century. With technological advancements, the shift towards online financial management became inevitable.

The Rise Of Ebanking

The rise of ebanking has transformed the banking industry in numerous ways. Online financial management offers several advantages, making it a preferred choice for many individuals. It provides convenience, allowing customers to access their accounts and perform transactions anytime, anywhere.

Ebanking eliminates the need for physical visits to the bank, saving time and effort. Additionally, it offers real-time access to account balances, transaction history, and statements. Through ebanking, customers can also set up automatic bill payments and schedule fund transfers effortlessly.

This not only streamlines personal finance management but also ensures timely payments and avoids late fees. Furthermore, ebanking enhances security by implementing robust authentication protocols and encryption measures. Overall, the rise of ebanking has revolutionized the banking industry, making financial management more accessible, efficient, and secure.

Convenience And Accessibility

Ebanking offers both convenience and accessibility, allowing customers to have 24/7 access to banking services. With online banking, individuals can easily manage their accounts and complete transactions at any time, from any location. They are no longer limited by the branch’s operating hours.

The features and tools of ebanking provide users with a range of functionalities. They can check their account balance, transfer funds, pay bills, and even set up automatic payments. Additionally, online banking platforms often offer budgeting tools and financial analytics, empowering individuals to monitor their spending habits and make informed decisions.

Moreover, ebanking provides a secure environment for transactions, ensuring the safety of personal and financial information. In this digital age, ebanking has become an essential part of our daily lives, making banking services easily accessible and hassle-free.

Enhanced Security Measures

Ebanking incorporates enhanced security measures through advanced encryption technologies and multi-factor authentication. These measures ensure secure transactions by protecting sensitive information with powerful encryption algorithms. Additionally, users are required to provide multiple forms of identification to access their accounts, adding an extra layer of protection.

With the growing prevalence of online threats, it is crucial to implement these security measures to safeguard personal and financial information. By adopting these advanced security technologies, ebanking platforms can offer their customers peace of mind when conducting banking transactions online.

With secure encryption and robust authentication processes in place, ebanking allows users to enjoy the convenience of online banking while maintaining the necessary levels of security. Safeguarding customer information is a top priority, and ebanking’s enhanced security measures play a critical role in achieving this goal.

Streamlined Financial Management

Ebanking allows for streamlined financial management, enabling real-time account monitoring along with automated bill payments and transfers. With this digital banking solution, you can effortlessly keep track of your transactions, ensuring that all your funds are being utilized efficiently. The convenience of being able to monitor your account in real-time offers a sense of security and peace of mind.

Additionally, automated bill payments eliminate the need for manual intervention, reducing the chances of late payments and potential penalties. Transfers between accounts, whether within the same bank or different financial institutions, can be quickly processed, saving you time and effort.

Ebanking simplifies your financial tasks, making it easier to stay on top of your finances without any hassle. Upgrade to ebanking today and experience the benefits of streamlined financial management.

Mobile Banking And App Innovations

Mobile banking platforms have witnessed significant growth in recent years. The integration of emerging features and technologies has revolutionized the way we conduct financial transactions. With the rise of smartphones, consumers now have the convenience of managing their finances on-the-go.

Mobile banking apps provide a plethora of innovative tools, such as biometric authentication, real-time notifications, and personalized financial insights. These advancements have made banking more accessible and user-friendly, empowering individuals to take control of their finances with just a few taps on their mobile devices.

Moreover, mobile banking platforms prioritize security and use encryption technology to safeguard sensitive information, ensuring a safe and reliable banking experience. The continuous evolution of mobile banking is testament to the industry’s commitment to providing seamless and efficient financial services in the digital age.

Integration Of Artificial Intelligence

Ebanking has seen a significant transformation with the integration of artificial intelligence (ai). Ai-powered chatbots have revolutionized customer support, providing prompt and efficient assistance. These chatbots utilize machine learning to offer personalized financial guidance, making banking more accessible and convenient for users.

By analyzing individual preferences and transaction history, ai algorithms can present tailored solutions and recommendations. This enhances the customer experience, saving time and effort while ensuring accurate and relevant information. With the power of ai, ebanking has reached new heights in providing seamless, user-friendly services.

Whether it’s answering queries or guiding users through complex financial decisions, ai-powered chatbots have become indispensable in the world of ebanking. With continuous advancements in ai technology, the future of ebanking looks promising, offering even more personalized and efficient services to customers.

Blockchain And Cryptocurrency Integration

Blockchain technology has emerged as a key driver of innovation in the e-banking industry. Its integration with cryptocurrencies has opened up new opportunities in online financial management. With increased security and transparency, blockchain enhances the efficiency of transactions, reducing the need for intermediaries.

Through decentralized ledgers, it allows for instant and cost-effective cross-border payments. Cryptocurrencies, such as bitcoin and ethereum, offer an alternative to traditional banking systems, allowing users to hold, transact, and invest in digital assets. As more businesses and individuals embrace blockchain and cryptocurrencies, the future of e-banking is set to be transformed.

The potential benefits include faster transactions, lower fees, and improved accessibility for the unbanked population. As technology continues to evolve, the integration of blockchain and cryptocurrency in e-banking is poised to revolutionize the way we manage our finances online.

Conclusion

In the fast-paced digital world, ebanking has proven to be a revolutionary concept that has transformed the way we handle our finances. With its secure and convenient features, ebanking has brought banking services to our fingertips, making transactions smoother, more efficient, and hassle-free.

By allowing us to access our accounts anytime, anywhere, ebanking has given us unprecedented control over our finances. Moreover, the ability to transfer money, pay bills, and check statements online has saved us valuable time, eliminating the need to visit physical bank branches.

The integration of advanced security measures ensures the protection of our personal and financial information, giving us peace of mind. Ebanking has also facilitated financial inclusion, making banking services accessible to those in remote areas or with physical constraints. With its continuous evolution and advancements, ebanking promises to shape the future of banking, making it more inclusive, efficient, and convenient than ever before.